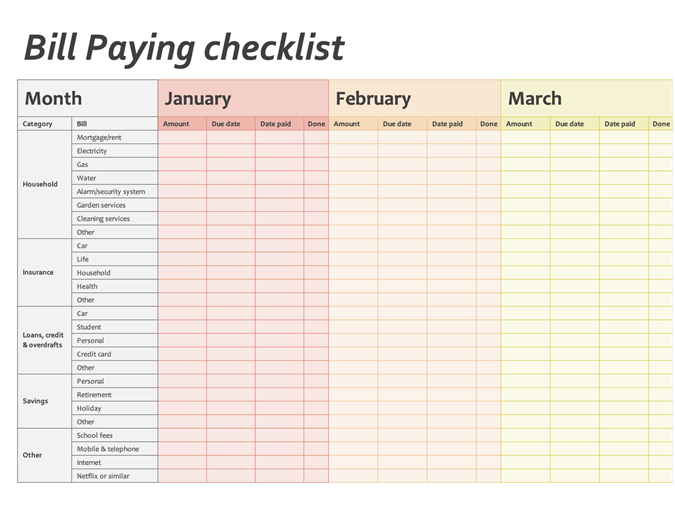

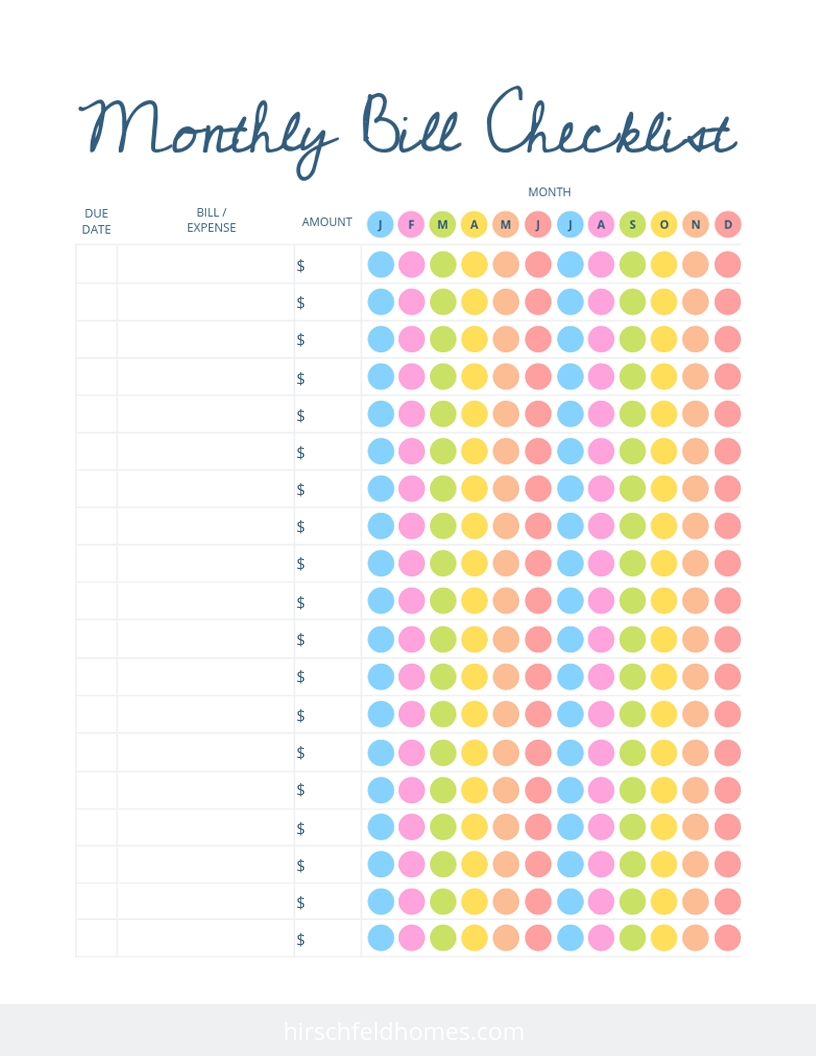

Once you have all of your bills listed out on scratch paper, you’ll want to transfer the information onto your Bill Payment Checklist. For bills that vary, you can put an estimated or average amount.

You can include the actual amount for recurring bills that are the same each month.

List the amountĭepending on your preferences, you may want to include the amount of the payment on your bill payment checklist. As you go through each bill, list each bill and also the day of the month it is due on a piece of notebook or scratch paper. For automatically paid bills, you may need to check your accounts online. I recommend gathering all of your statements or using a scratch piece of paper for this step as you organize your bills. I think you’ll like it so much that once you start using it you won’t want to track bill payments any other way. Using the Bill Payment Checklist form we’ve created here at Cents and Order is simple. But the right bill paying system could’ve helped me get the bill paid on time even though I hadn’t received the actual statement in the mail.Įven if you are great about paying the bills when they come in, what happens if you don’t get the bill? Using a Bill Payment Checklist will remind of you of all your bills – even if the bill gets lost.

BILLS TO PAY CHECKLIST PLUS

So I went back through my files plus the papers on my desk looking to find the bill. It had been a busy couple of weeks in our household and I figured that with all the chaos, I just missed the bill. In my case the missed payment was simply a lack of being organized. There’s something about getting calls from creditors that can be a little intimidating. But imagine if a lack of a bill paying system resulted in you getting reminder calls from creditors on a regular basis. For me, that’s a big deal – I am pretty meticulous with my finances. The second reason is that when you don’t pay your bills on time, you can be setting yourself up for trouble.Īs an example, one day, I received a phone call that one of my bills was late. The first is that using a system that works for you will make life less stressful. Using some type of system to keep track of and to pay your bills is important for a couple of reasons. It will also provide you a quick overview of what bills you have upcoming and a way to track your payments. The Bill Payment Checklist form is simple go-to form that will list all of your bills and give you a way to remember what needs to be paid – and when. I like to keep track of my bills on a little form called a Bill Payment Checklist. Knowing what bills you have and when they’re due will give you the main information you have to have in order to create a budget. Even if you don’t have a budget created yet, this is the beginning to getting your finances organized. But never fear: we’ll start with a much smaller task so you can be on your way to better budgeting!īefore you even begin to think about budgeting, you need to know what bills you have each month and when they are due. You may have seen those pretty financial/budget binders on Pinterest and thought it takes way too much time to be that organized. For some people, organization comes naturally but for others, not so much. One of the best ways to keep your finances in check is to be organized.

0 kommentar(er)

0 kommentar(er)